随机波动率的 Levy 稳定分布模型¶

Levy Stable models of Stochastic Volatility

本教程通过一个非高斯随机波动率模型(non-Gaussian stochastic volatilty model)的启发性例子,演示了使用 Levy Stable distribution 进行推断。

Inference with stable distribution is tricky because the density Stable.log_prob() is not defined. In this tutorial we demonstrate two approaches to inference: (i) using the poutine.reparam effect to transform models in to a tractable form, and (ii) using the likelihood-free loss EnergyDistance with SVI.

Summary¶

Stable.log_prob() is undefined.

Stable inference requires either reparameterization or a likelihood-free loss.

Reparameterization:

The poutine.reparam() handler can transform models using various strategies.

The StableReparam strategy can be used for Stable distributions in SVI or HMC.

The LatentStableReparam strategy is a little cheaper, but cannot be used for likelihoods.

The DiscreteCosineReparam strategy improves geometry in batched latent time series models.

Likelihood-free loss with SVI:

The EnergyDistance loss allows stable distributions in the guide and in model likelihoods.

Table of contents¶

Fitting a single distribution to log returns using

EnergyDistanceModeling stochastic volatility using

poutine.reparam

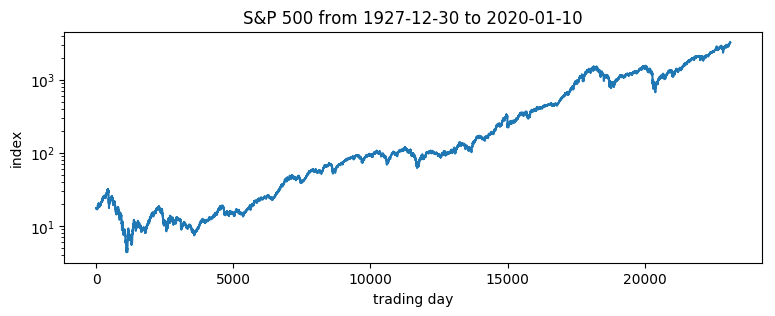

Daily S&P 500 data¶

The following daily closing prices for the S&P 500 were loaded from Yahoo finance.

[1]:

import math

import os

import torch

import pyro

import pyro.distributions as dist

from matplotlib import pyplot

from torch.distributions import constraints

from pyro import poutine

from pyro.contrib.examples.finance import load_snp500

from pyro.infer import EnergyDistance, Predictive, SVI, Trace_ELBO

from pyro.infer.autoguide import AutoDiagonalNormal

from pyro.infer.reparam import DiscreteCosineReparam, StableReparam

from pyro.optim import ClippedAdam

from pyro.ops.tensor_utils import convolve

%matplotlib inline

assert pyro.__version__.startswith('1.3.0')

pyro.enable_validation(True)

smoke_test = ('CI' in os.environ)

[2]:

df = load_snp500()

dates = df.Date.to_numpy()

x = torch.tensor(df["Close"]).float()

x.shape

[2]:

torch.Size([23116])

[3]:

pyplot.figure(figsize=(9, 3))

pyplot.plot(x)

pyplot.yscale('log')

pyplot.ylabel("index")

pyplot.xlabel("trading day")

pyplot.title("S&P 500 from {} to {}".format(dates[0], dates[-1]));

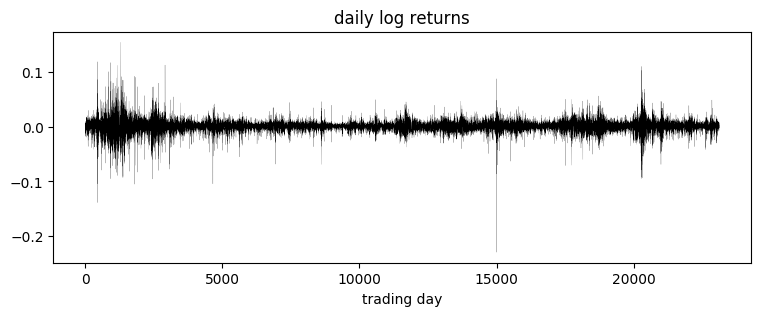

Of interest are the log returns, i.e. the log ratio of price on two subsequent days.

[4]:

pyplot.figure(figsize=(9, 3))

r = (x[1:] / x[:-1]).log()

pyplot.plot(r, "k", lw=0.1)

pyplot.title("daily log returns")

pyplot.xlabel("trading day");

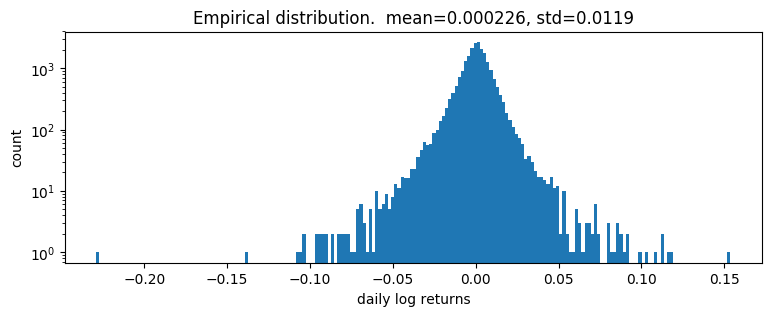

[5]:

pyplot.figure(figsize=(9, 3))

pyplot.hist(r, bins=200)

pyplot.yscale('log')

pyplot.ylabel("count")

pyplot.xlabel("daily log returns")

pyplot.title("Empirical distribution. mean={:0.3g}, std={:0.3g}".format(r.mean(), r.std()));

Fitting a single distribution to log returns¶

Log returns appear to be heavy-tailed. First let’s fit a single distribution to the returns. To fit the distribution, we’ll use a likelihood free statistical inference algorithm EnergyDistance, which matches fractional moments of observed data and can handle data with heavy tails.

[6]:

def model():

stability = pyro.param("stability", torch.tensor(1.9),

constraint=constraints.interval(0, 2))

skew = 0.

scale = pyro.param("scale", torch.tensor(0.1), constraint=constraints.positive)

loc = pyro.param("loc", torch.tensor(0.))

with pyro.plate("data", len(r)):

return pyro.sample("r", dist.Stable(stability, skew, scale, loc), obs=r)

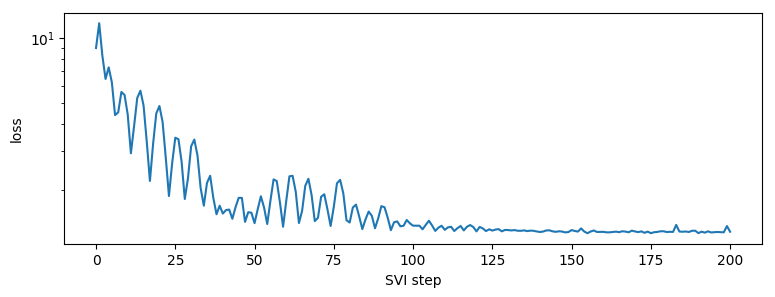

[7]:

%%time

pyro.clear_param_store()

pyro.set_rng_seed(1234567890)

num_steps = 1 if smoke_test else 201

optim = ClippedAdam({"lr": 0.1, "lrd": 0.1 ** (1 / num_steps)})

svi = SVI(model, lambda: None, optim, EnergyDistance())

losses = []

for step in range(num_steps):

loss = svi.step()

losses.append(loss)

if step % 20 == 0:

print("step {} loss = {}".format(step, loss))

print("-" * 20)

pyplot.figure(figsize=(9, 3))

pyplot.plot(losses)

pyplot.yscale("log")

pyplot.ylabel("loss")

pyplot.xlabel("SVI step")

for name, value in sorted(pyro.get_param_store().items()):

if value.numel() == 1:

print("{} = {:0.4g}".format(name, value.squeeze().item()))

step 0 loss = 8.961664199829102

step 20 loss = 4.8506011962890625

step 40 loss = 1.5543489456176758

step 60 loss = 1.7787070274353027

step 80 loss = 1.4140945672988892

step 100 loss = 1.3671720027923584

step 120 loss = 1.287503719329834

step 140 loss = 1.2791334390640259

step 160 loss = 1.2810490131378174

step 180 loss = 1.2784368991851807

step 200 loss = 1.2823134660720825

--------------------

loc = 0.0003696

scale = 0.00872

stability = 1.977

CPU times: user 15.6 s, sys: 521 ms, total: 16.1 s

Wall time: 2.38 s

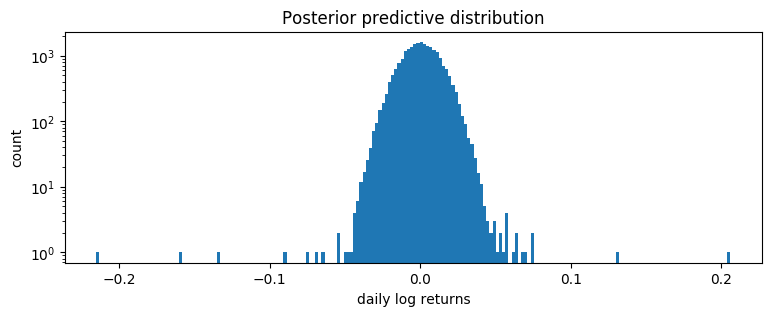

[8]:

samples = poutine.uncondition(model)().detach()

pyplot.figure(figsize=(9, 3))

pyplot.hist(samples, bins=200)

pyplot.yscale("log")

pyplot.xlabel("daily log returns")

pyplot.ylabel("count")

pyplot.title("Posterior predictive distribution");

This is a poor fit, but that was to be expected since we are mixing all time steps together: we would expect this to be a scale-mixture of distributions (Normal, or Stable), but are modeling it as a single distribution (Stable in this case).

Modeling stochastic volatility¶

We’ll next fit a stochastic volatility model. Let’s begin with a constant volatility model where log price \(p\) follows Brownian motion

where \(w_t\) is a sequence of standard white noise. We can rewrite this model in terms of the log returns \(r_t=\log(p_t\,/\,p_{t-1})\):

Now to account for volatility clustering we can generalize to a stochastic volatility model where volatility \(h\) depends on time \(t\). Among the simplest such models is one where \(h_t\) follows geometric Brownian motion

where again \(v_t\) is a sequence of standard white noise. The entire model thus consists of a geometric Brownian motion \(h_t\) that determines the diffusion rate of another geometric Brownian motion \(p_t\):

Usually \(v_1\) and \(w_t\) are both Gaussian. We will generalize to a Stable distribution for \(w_t\), learning three parameters (stability, skew, and location), but still scaling by \(\sqrt h_t\).

Our Pyro model will sample the increments \(v_t\) and record the computation of \(\log h_t\) via pyro.deterministic. Note that there are many ways of implementing this model in Pyro, and geometry can vary depending on implementation. The following version seems to have good geometry, when combined with reparameterizers.

[9]:

def model(data):

# Note we avoid plates because we'll later reparameterize along the time axis using

# DiscreteCosineReparam, breaking independence. This requires .unsqueeze()ing scalars.

h_0 = pyro.sample("h_0", dist.Normal(0, 1)).unsqueeze(-1)

sigma = pyro.sample("sigma", dist.LogNormal(0, 1)).unsqueeze(-1)

v = pyro.sample("v", dist.Normal(0, 1).expand(data.shape).to_event(1))

log_h = pyro.deterministic("log_h", h_0 + sigma * v.cumsum(dim=-1))

sqrt_h = log_h.mul(0.5).exp().clamp(min=1e-8, max=1e8)

# Observed log returns, assumed to be a Stable distribution scaled by sqrt(h).

r_loc = pyro.sample("r_loc", dist.Normal(0, 1e-2)).unsqueeze(-1)

r_skew = pyro.sample("r_skew", dist.Uniform(-1, 1)).unsqueeze(-1)

r_stability = pyro.sample("r_stability", dist.Uniform(0, 2)).unsqueeze(-1)

pyro.sample("r", dist.Stable(r_stability, r_skew, sqrt_h, r_loc * sqrt_h).to_event(1),

obs=data)

We use two reparameterizers: StableReparam to handle the Stable likelihood (since Stable.log_prob() is undefined), and DiscreteCosineReparam to improve geometry of the latent Gaussian process for v. We’ll then use reparam_model for both inference and prediction.

[10]:

reparam_model = poutine.reparam(model, {"v": DiscreteCosineReparam(),

"r": StableReparam()})

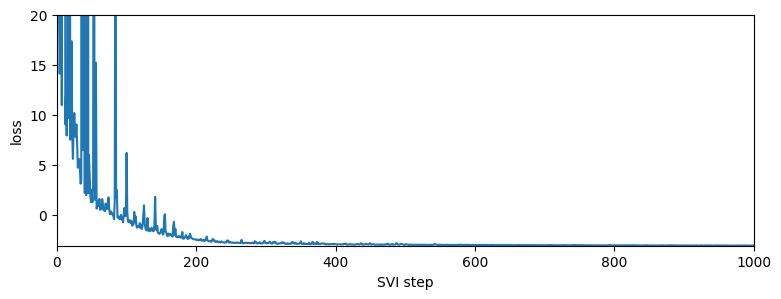

[11]:

%%time

pyro.clear_param_store()

pyro.set_rng_seed(1234567890)

num_steps = 1 if smoke_test else 1001

optim = ClippedAdam({"lr": 0.05, "betas": (0.9, 0.99), "lrd": 0.1 ** (1 / num_steps)})

guide = AutoDiagonalNormal(reparam_model)

svi = SVI(reparam_model, guide, optim, Trace_ELBO())

losses = []

for step in range(num_steps):

loss = svi.step(r) / len(r)

losses.append(loss)

if step % 50 == 0:

median = guide.median()

print("step {} loss = {:0.6g}".format(step, loss))

print("-" * 20)

for name, (lb, ub) in sorted(guide.quantiles([0.325, 0.675]).items()):

if lb.numel() == 1:

lb = lb.detach().squeeze().item()

ub = ub.detach().squeeze().item()

print("{} = {:0.4g} ± {:0.4g}".format(name, (lb + ub) / 2, (ub - lb) / 2))

pyplot.figure(figsize=(9, 3))

pyplot.plot(losses)

pyplot.ylabel("loss")

pyplot.xlabel("SVI step")

pyplot.xlim(0, len(losses))

pyplot.ylim(min(losses), 20)

step 0 loss = 80.7915

step 50 loss = 2.49764

step 100 loss = 6.18623

step 150 loss = -1.42891

step 200 loss = -2.48601

step 250 loss = -2.75234

step 300 loss = -2.80716

step 350 loss = -2.64854

step 400 loss = -2.93349

step 450 loss = -2.90964

step 500 loss = -2.93564

step 550 loss = -2.98376

step 600 loss = -3.01648

step 650 loss = -3.01208

step 700 loss = -3.04329

step 750 loss = -3.03045

step 800 loss = -3.04258

step 850 loss = -3.06856

step 900 loss = -3.05272

step 950 loss = -3.06414

step 1000 loss = -3.06487

--------------------

h_0 = 0.3713 ± 0.01079

r_loc = 0.05134 ± 0.002976

r_skew = 0.0001597 ± 0.0002002

r_stability = 1.92 ± 0.001772

sigma = 0.2373 ± 0.000313

CPU times: user 38.1 s, sys: 6.95 s, total: 45.1 s

Wall time: 45.1 s

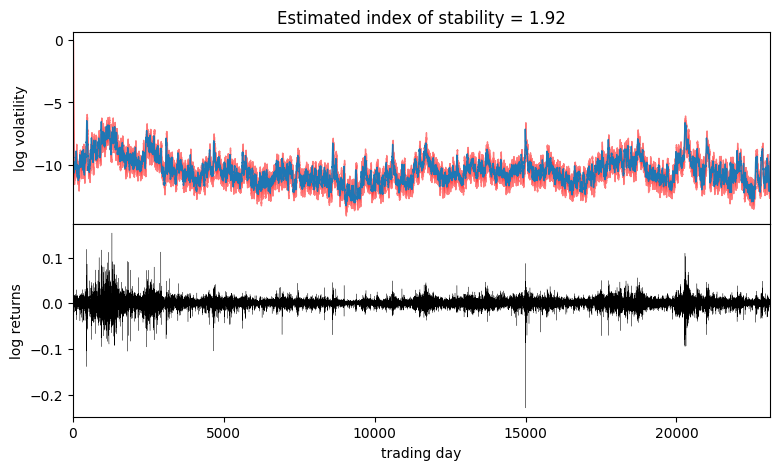

It appears the log returns exhibit very little skew, but exhibit a stability parameter slightly but significantly less than 2. This contrasts the usual Normal model corresponding to a Stable distribution with skew=0 and stability=2. We can now visualize the estimated volatility:

[12]:

fig, axes = pyplot.subplots(2, figsize=(9, 5), sharex=True)

pyplot.subplots_adjust(hspace=0)

axes[1].plot(r, "k", lw=0.2)

axes[1].set_ylabel("log returns")

axes[1].set_xlim(0, len(r))

# We will pull out median log returns using the autoguide's .median() and poutines.

with torch.no_grad():

pred = Predictive(reparam_model, guide=guide, num_samples=20, parallel=True)(r)

log_h = pred["log_h"]

axes[0].plot(log_h.median(0).values, lw=1)

axes[0].fill_between(torch.arange(len(log_h[0])),

log_h.kthvalue(2, dim=0).values,

log_h.kthvalue(18, dim=0).values,

color='red', alpha=0.5)

axes[0].set_ylabel("log volatility")

stability = pred["r_stability"].median(0).values.item()

axes[0].set_title("Estimated index of stability = {:0.4g}".format(stability))

axes[1].set_xlabel("trading day");

Observe that volatility roughly follows areas of large absolute log returns. Note that the uncertainty is underestimated, since we have used an approximate AutoDiagonalNormal guide. For more precise uncertainty estimates, one could use HMC or NUTS inference.